The crypto industry might still be new but it has stayed for a while than expected and so tax is a foreseeable item.

With the persistent involvement of the IRS to enforce crypto tax compliance, it becomes necessary for every investor to know how to generate income reports for tax.

And in this post, we will share insights how an investor can generate income tax reports using the Cryptotrader.tax software.

Using the software helps crypto investors save time and effort. With the software, investors can efficiently manage their crypto assets, compute their capital gains or loss and generate an income report.

Disclosure: Please note that some of the links below are affiliate links and we earn a commission if you purchase through one of those links, at no cost to you. You will get a 10% discount coupon when you subscribe with the promo code CRYPTOTAX10.

Key Takeaways

• Virtual currency received as payment for services means crypto is earned as income instead of cash

• Irrespective of how a crypto is earned, an investor needs to record the value of the crypto in U.S. dollars when it’s received and report that income on the tax return.

• Earning crypto income is considered personal income subject to income tax, and this includes crypto staking rewards, interest, and referral rewards.

• Cryptotrader.tax now known as CoinLedger app Is the best platform to help manage your crypto asset and transactions.

SEE ALSO: How Does Crypto Taxes Work (All You Need to Know)

SEE ALSO: How To Avoid Crypto Taxes (4 Legal Ways)

Reporting Crypto on Your Taxes

Most crypto investors have only sold, purchased, and traded their crypto assets through exchanges, resulting in only capital gains crypto investment transactions. The income accrued from such investments is known as capital gain income and the taxes are reported as capital gain income.

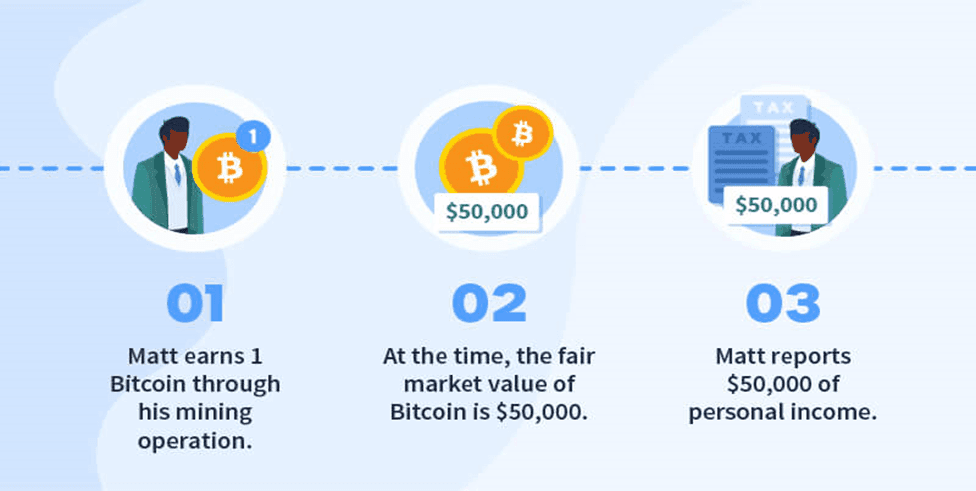

Other investors earn their crypto assets via a job, interest, referral reward, mining, and staking. The income earned from this method is referred to as ordinary income and It is recorded on the tax report as ordinary income.

Below we will talk about how crypto investors can report tax on the various income types listed above.

The best way to get things done easier is through the cryptotrader.tax platform. You can sign up with the link here. You will get a 10% discount coupon when you subscribe with the promo code CRYPTOTAX10.

Reporting Crypto Capital Gains and Losses

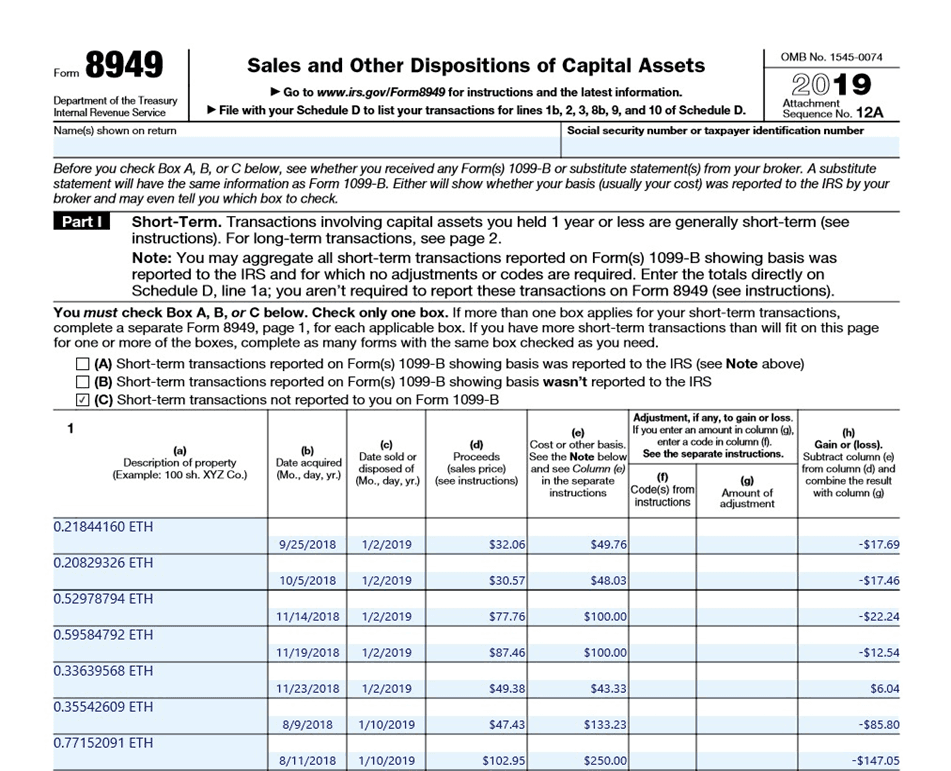

Every crypto investor’s capital gains and losses from trading are reported on IRS Form 8949.

Form 8949 is the tax form used to report the sales and disposals of capital assets, including cryptocurrency. Capital assets of other investment sectors include stocks and bonds.

Filling the Form 8949 is very easy. First, list all of your cryptocurrency transactions, sells, and disposals on Form 8949 including the date of acquiring the crypto asset, date of sale, the gains accrued (Fair Market Value), the cost basis, and the capital gain and loss during the trading period.

After listing each trade, add them and fill in the net capital gain or loss for the year. This is usually located at the bottom of the form.

Reporting Crypto Ordinary Income

Based on the specific situation, the ordinary income received is reported on a different tax form, unlike the capital gains and losses.

Schedule C – Income earned as a business entity, like receiving payments for a job or running a cryptocurrency mining operation, is often treated as self-employment income and is reported on Schedule C.

Schedule B – Income earned from staking or interest rewards from lending out your crypto, this is generally reported on Schedule B.

Schedule 1 – Income earned from airdrops, forks, or other wages and hobby income, are generally reported on Schedule 1 as other income.

To effectively manage such income, CoinLedger generates a complete income report that is included with your completed crypto tax reports. This report details the US Dollar value of all of your cryptocurrency income events that you received throughout the year: mining, staking, airdrops, and more.

This income report can be used to complete your relevant ordinary income tax forms like Schedule 1, Schedule B, and Schedule C. You can get started with this link. You will get a 10% discount coupon when you subscribe with the promo code CRYPTOTAX10.

The Crypto Tax Reporting Solution

The best way to treat the issue of tax problems is to allocate all your cryptocurrency data aggregated into one platform. This includes your purchases, sales, trades, forks, mined coins, Airdrops, swaps, received income, and exchanges.

This allows you to create a precise tax profile with all data of transactions included. Calculating your cost basis, fair market values, gains/losses, and income of all transactions will be easier.

While all of these can be done manually, which will be exhausting you can do it more efficiently with crypto tax software.

SEE ALSO: How To Get Your Cryptocurrency Tax Done In Minutes With Cryptotrader.Tax

Crypto Tax Software

Cryptocurrency tax software like CoinLedger is a software that is created to automate the entire crypto tax reporting process.

Here’s how it works:

1. Select each of the cryptocurrency exchanges, wallets, and platforms you’ve used throughout the years.

2. Import your historical transactions by connecting your accounts via API or uploading the CSV transaction history report exported by your exchanges.

3. Finally, generate your tax reports based on this imported data with the click of a button.

Once done, your tax report will be generated. You can simply send them to the necessary professional bodies or import them to the personal tax software you use.

Crytotrader.tax to CoinLedger

Crytotrader.tax has officially announced a change of name to CoinLedger. The rebrand was initiated to provide better services to investors apart from just tax reporting.

With more innovation being initiated in the crypto industry, it becomes quite hard to keep track of your crypto assets. That is where CoinLedger comes in. It simply helps investors keep track of their crypto assets.

Final Thoughts

Generating Income reports for tax use can be a daunting task if you try to do it manually. It can become tedious and confusing.

The best way to go is with the use of a platform that automatically computes all your data and transactions. Cryptotrader.tax is one of the best software online that can help with generating your income tax report.

The software helps investors manage their crypto data and transaction effectively and efficiently.

Read More