Just as a bank processes and authorizes currency (fiat) transactions so is the task of authorization and validation of crypto transactions required of miners.

Miners are required to validate cryptocurrency transactions and add them to the blockchain or public ledger.

As long as Bitcoin, Dogecoin, Ethereum, Shiba Inu, PancakeSwap, and a host of other coins continue to adopt the proof-of-work (PoW) consensus mechanism, crypto mining will continue to thrive. This now makes crypto mining inevitable and viable as long as crypto remains a means of sending and receiving payment.

A lot of crypto mining investors have recorded tremendous gains mining cryptocurrencies and we expect this trend to continue in the coming years.

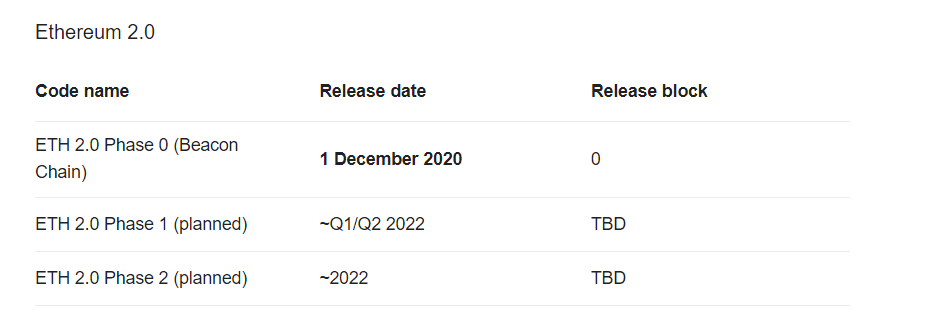

Ethereum.org is planning to launch its ETH 2.0 version soon which will run on a proof-of-stake (PoS) mechanism, this move will take ETH off the list of coins that can be mined.

The question is…

Will crypto mining (hardware mining or cloud mining) be sustained in the long term as many coins and tokens change their consensus from PoW to PoS?

Most miners test the waters by taking the cloud mining route due to lower entry barriers and set up costs generally. With many crappy mining websites out there, one needs to sift through to avoid investing on the wrong platform.

I’ll highlight key factors that could affect cloud mining income in the coming year. You can also check our list of legit cloud mining websites.

Key Takeaways

• Recently, there have been a sizable number of scammy websites masquerading as legit cloud mining platforms. Hence, the need for proper research before making use of a cloud mining platform.

• Cloud mining, if done the right way, has the potential to reward the miner.

• In July 2021, China experienced a crackdown that led to many miners going offline, leading to high profits for the few who were online.

• Taking into consideration the factors affecting cloud mining income is a step in the right direction if you are looking to invest in cloud mining as a beginner.

Apart from trading (buying and selling), Bitcoin mining is another way to earn a decent financial reward.

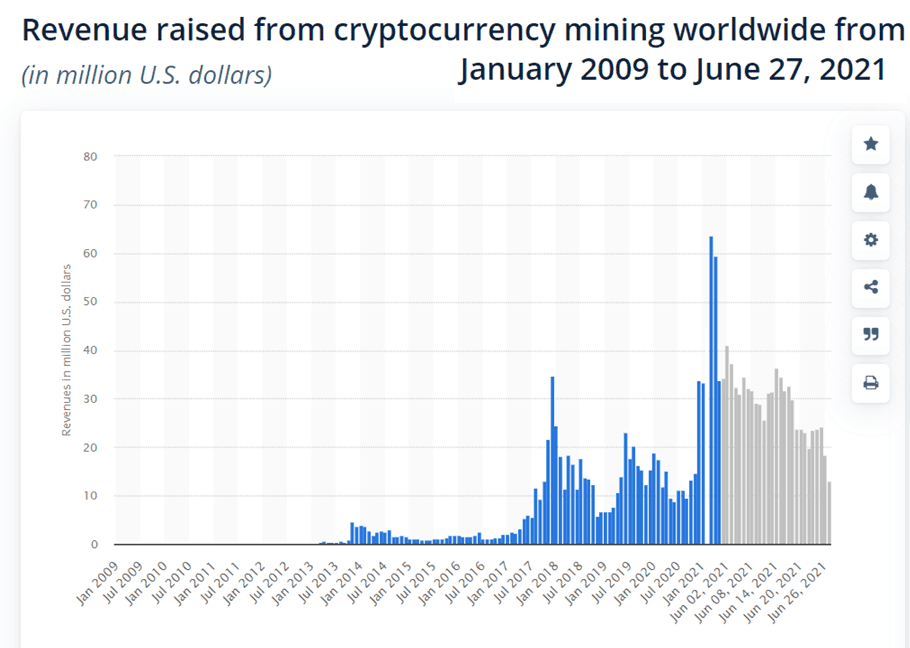

Since the creation of Bitcoin in 2009, mining BTC and other mineable altcoins have boosted revenue worldwide since January 2009.

It’s known that mining cryptocurrency is an expensive endeavor, especially if you’re purchasing a piece of mining hardware or setting up a rig yourself.

The truth is…

You do not need to go through all those hassles anymore, especially if you’re just a beginner looking to explore other earning potentials in the crypto space.

The answer to fixing the crypto mining challenge is …” Cloud Mining“.

In a nutshell, cloud mining is simply subscribing or buying a monthly or annual mining plan from large Bitcoin mining pools, and they just do the mining for you and payout earnings daily, weekly, or monthly after deducting miner-maintenance fees.

Factors Influencing Cloud Mining Income

With new mining sites springing up every day, one needs to be careful where they sign up for a mining plan.

The “scam-scare” is everywhere, with investors losing money on one Bitcoin scam website or the other.

However, it’s vital to remember that with cloud mining, you’re dependent on someone else or a platform to mine cryptocurrency for you. It is, in essence, a sort of investment in which you are risking your money on the success of someone else.

In terms of income, cloud mining has the potential to generate a decent income in BTC, to begin with, cloud miners do not need to purchase any gear or software to earn income.

Purchasing a piece of mining equipment is expensive ($1500 – $15000+) and operating/running it is also costly as well. But most miners say that they make back the cost of capital outlay for a piece of mining equipment in 6-8 months during bull market periods. This largely depends on the initial cost of the mining hardware, the mined cryptocurrency, electricity costs, volatility in the market, and a host of other factors.

Moving on, the factors that do affect cloud mining income are:

- Bitcoin halving

- Mining plan or contract

- Mining Power

- Mining Hardware

- Bitcoin Market Rate

- Network Hash Rate

1. Bitcoin Halving

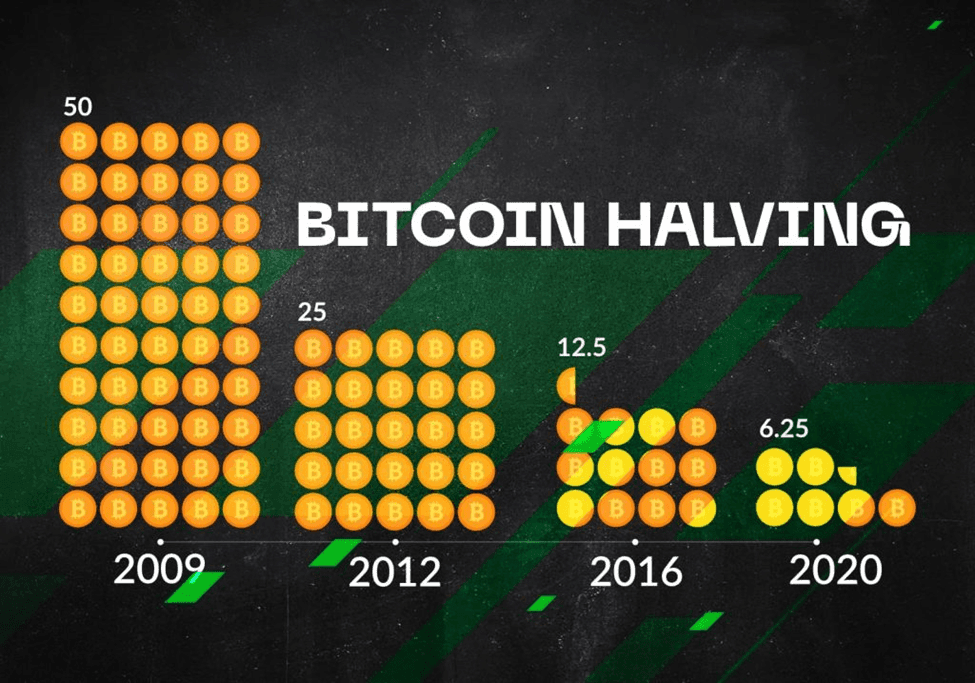

Bitcoin halving is an event in which the earnings for Bitcoin mining are shared in half. Halving helps to reduce inflation and manage the number of Bitcoins in circulation, therefore, retaining its value and controlling its supply.

Halving to miners may not seem like a good thing since their earning potential is reduced by half. The halving impact on miners is sort of mild due to the volume of transactions done daily covering up for the halved paycheck.

The last Bitcoin halving was May 11 2020 where 12.5BTC which was a mining reward per block of BTC was halved to 6.25BTC. The next Bitcoin halving is between February and June 2024.

It is important to have this in mind if you’re considering mining BTC.

2. Mining Plan or Contract

Cloud mining comes with numerous offers, terms, and conditions, and as such the space is a bit saturated but competitive (to the benefit of miners).

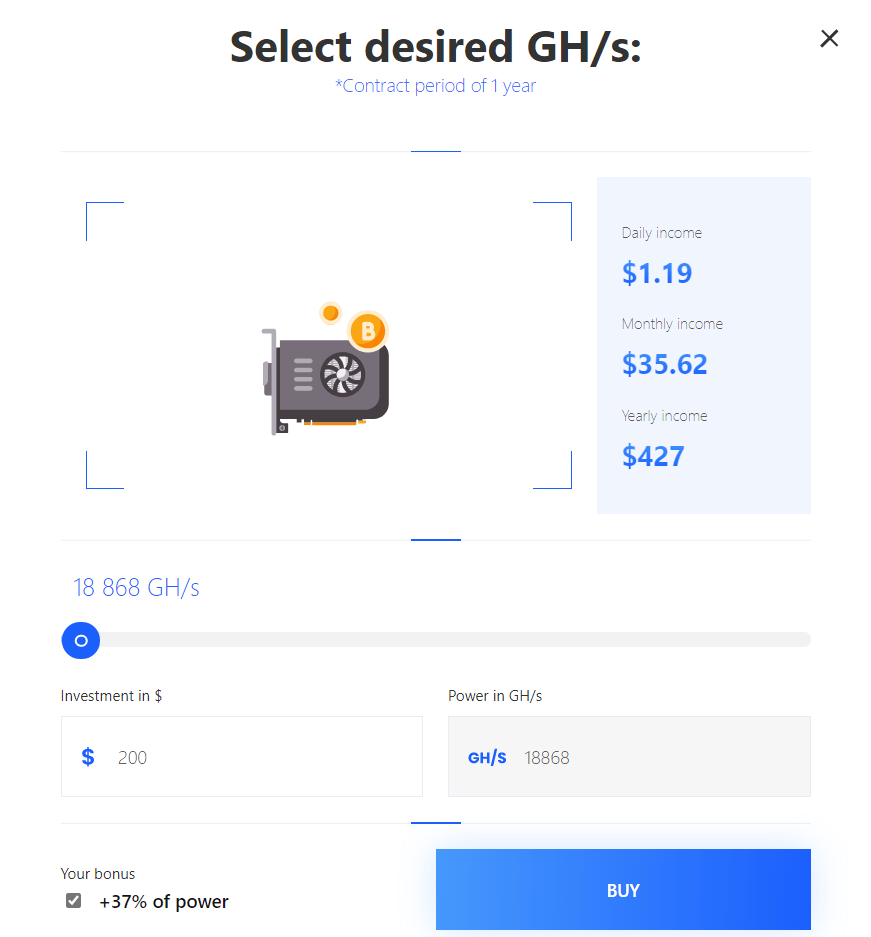

The cloud ming plan is to sign up for goes a long way in determining your ROI. GPU Miners are rented out in most plans according to them mining hash-rates measured usually in GH/s.

The higher the hashing rate, the higher the potentials for earning. When determining your income potential, this is a factor you can control.

For example, Shamining provides such mining services where you can determine (upfront) your earning potential with their interactive Income checker.

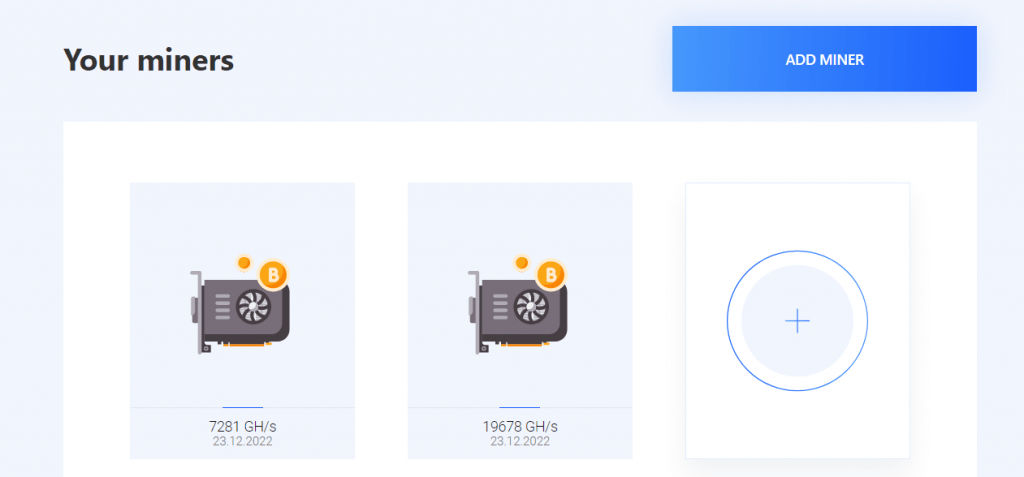

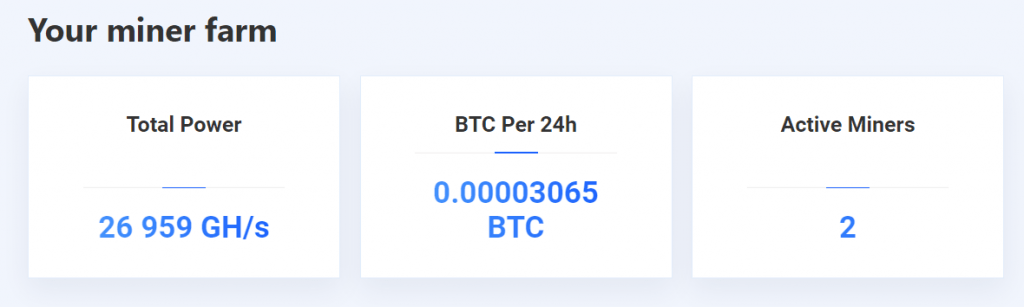

Once you purchase a mining contract (usually lasts for a year), GPU miners will be added to your online mining farm. You can build or add as many as possible.

There are a host of other cloud mining contracts such as UnMineable, IQMining, and Genesis Mining provide profitable yearly mining contracts.

3. Mining Algorithm

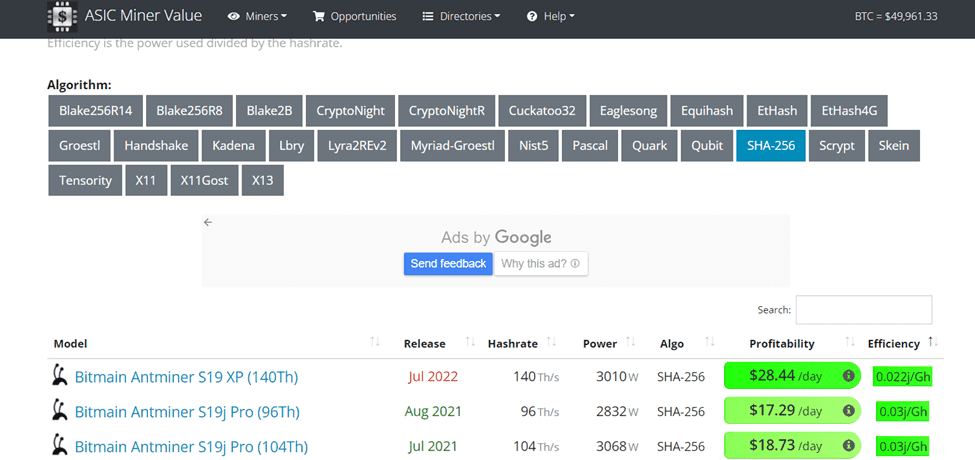

Mining power is a function of the mining algorithm (EtHash, SHA-256), the hash rate (Th/s, Gh/s), power (wattage), noise output (decibels), and ultimately, profitability.

All these put together determines the power of the miner and its ability to mine a cryptocurrency efficiently.

The image below reveals the efficiency of 3 different Bitmain miners running with the SHA-256 algorithm. To see more ASIC miners, check here.

The higher your mining power, the faster the validation through the PoW mechanism which in turn translates to more earnings for you.

If you own a mining rig or intend to purchase one, checking your mining hardware potential ahead helps you determine your cost and expected profitability. If you’re cloud mining, all mining stats will be displayed on your mining dashboard.

4. Mining Hardware

One popular form of crypto mining is Hosted mining.

With this model, the miner purchases or leases mining hardware located in a miner’s facility. The miner is responsible for maintaining the equipment and ensuring that it functions as intended.

Hence, mining hardware that is in good condition will most likely deliver returns. efficient results and a higher mining income for the investor than one that is in bad condition.

5. Market Volatility

This is also another factor that could influence your cloud mining income.

When the price of the mined cryptocurrency such as Bitcoin rises, the value of your mined crypto appreciates as well.

Cloud mining and every other type of crypto mining are favorable in the bullish market.

But when the bear appears and the price of Bitcoin and other crypto plummets mined earnings lose value.

Bitcoin Price Chart

[mcrypto id=”186″]

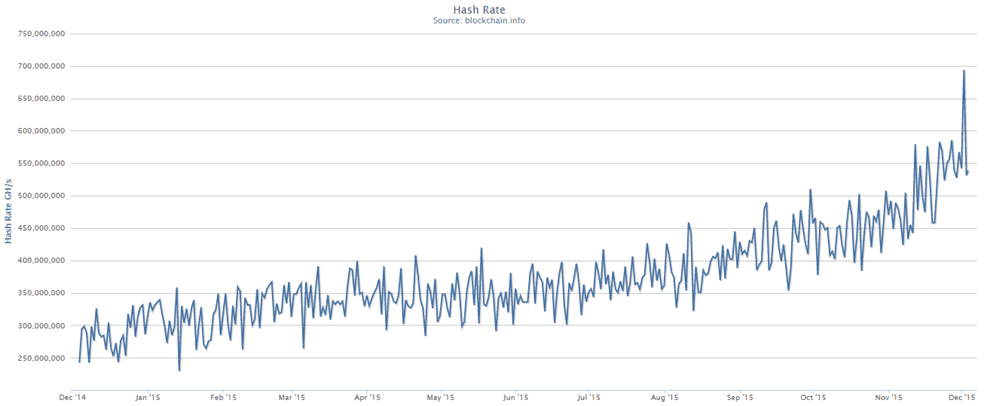

6. Network Hash Rate

A network hash rate is ameasure of how many miners are involved in managing the network.

There was a drop-off in miners from the bitcoin mining network in July 2021 due to the crackdown on mining in China.

What this implies is that miners will face reduced competition which in turn will boost the mining hash rate of individual mining contracts, plans, and projects.

Moving Forward

As mentioned earlier, there are lots of cloud mining sites on the internet today.

Some websites clone the originals to steal the privacy and funds of an unsuspecting investor. You must do a thorough check before settling for a cloud mining site.

Checking out what a site has to offer, user reviews on Trust Pilot, and, mining contract maintenance fees, etc. Start small to test out the platform before investing larger sums.

Take out your profits and leave capital (optional).

Mining coins with a strong fundamental and track record of quality performance like Bitcoin. Shamining is one of the best places to mine Bitcoin.

Frequently Asked Questions (FAQs)

Is Cloud Mining Profitable?

Yes, cloud mining can be profitable. You may incur some costs in the process of engaging in cloud mining, but if done right, you will reap profits from the venture.

Is it Unlawful to Mine Bitcoin?

The legality of Bitcoin mining is dependent on your geographical area. The notion of Bitcoin has the potential to undermine fiat currency supremacy and government control over financial markets. As a result, Bitcoin is entirely banned in some jurisdictions.

Final Thoughts

Cloud mining is one of the ways you can make passive income from crypto after proper research has been carried out.

Bear in mind that I listed some factors above that could affect the income you would get from engaging in this activity, so I encourage you to go through them before deciding as to whether to engage in cloud mining or not.

Read More