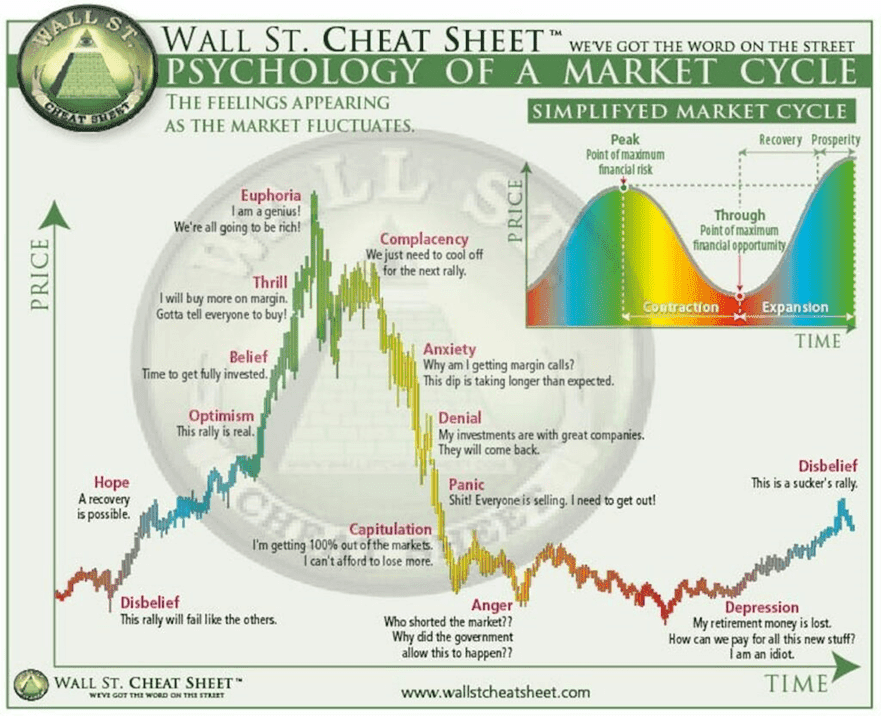

Cryptocurrencies usually come in twists and turns, at a time they are soaring in price, and the other time they are dwindling.

These trends usually lead to what we call crypto cycles, and once mastered by crypto investors, it becomes easy for them to know when to buy and hold and when to sell-off.

A lot of investors usually think they understand the risks involved in crypto, but some of them, at the end of the day, will still fall into the crypto trap when the market crashes and prices drop fast.

To help prevent this, I’ll explain what crypto cycles are and show you some strategies for determining when to invest or not in this article.

Key Takeaways

• Crypto market cycles do not have a specific duration in which they last as they could range from a few days to sometimes a few weeks all depending on the market.

• The four stages of the crypto market cycle represent the price swings that occur in the crypto market cycle.

• Investors caught up in the markdown phase of the crypto market cycle are usually those who are new and inexperienced.

• Emotions such as greed and excitement are part of the reasons why investors make hurried decisions which they later regret in the form of incurred losses.

SEE ALSO: 5 Tested Ways of Buying the Dip in the Crypto Market

SEE ALSO: How to Avoid Panic Selling in a Cryptocurrency Dip

What Is the Crypto Market Cycle?

A crypto market cycle is simply a term used to describe the period between a market’s highs and lows, as well as its phases.

Just as we have in the traditional financial markets, business, and market cycles, the same thing is also applicable to crypto.

The only difference is that the period of the crypto cycle may be shorter than those present in the traditional markets due to the quicker price fluctuations in the crypto market.

This cycle, be it in the crypto or traditional market, is a natural occurrence that will come and go after a particular period, so long as the right actions are taken.

Bitcoin Market Cycles: Key Points

1. In 2009, when bitcoin was created, the market cycle at that time lasted for about 4 years.

2. The BTC halving event usually takes place once every four years, right at about the same time as when a market cycle is taking place. This is what happened in 2012, 2016, and 2020 halving events.

3. In each crypto cycle, the price of the low of that cycle in the current year was always higher than the price of the high of that cycle in the past four years. For instance, the lowest price of 2017’s cycle at $3120 was way above the 2013 cycle’s high at $1150, and the lowest price of 2021’s cycle at $26,000 was higher than the high of 2017’s cycle at $20,000.

4. In the long run, bitcoin is a non-inflationary crypto-currency whose purchasing power will increase over time.

Getting to know the Market Cycles

Cycles can be easily detected in every type of market, and they usually do come in stages. Prices rise, get to the peak level, fall, and then rise again. After a while, another cycle begins.

Inexperienced traders usually do not grasp what market cycles are and how they affect the market. For this reason, they may fail to account for it.

Notwithstanding, predicting the highs and lows of a market cycle is no easy task, and investors who are quite experienced should endeavor to deeply understand the cycle trends if they are to trade successfully.

Moving on, let me show you the four key phases of the average market cycle and how you can spot them.

The Accumulation Phase

The accumulation phase occurs when the crypto market cycle has reached the bottom after previously ascending to a high.

This phase implies that prices have stabilized and that investors and traders can begin buying crypto again with the belief that the worst days are behind them and that they stand a chance of making considerable returns on their buys.

It is for this reason that clever buyers are willing to get some crypto off the hands of sellers who are willing to let go of some at an agreed bargain.

The accumulation phase usually comes with a lack of interest from investors who suddenly become risk-averse due to previous market conditions and as a result of fear on their part as well.

But all this soon vanishes as the market gradually improves from a place of negativity to a place of neutrality.

The Markup Phase

Here in the markup phase, the crypto market is beginning to take off while maintaining constant upward levels. This is when smart investors begin to capitalize after detecting these market developments, although growth might still be moving slowly due to sellers still restricting upward price movements.

Other investors, by the way, begin to show interest as the cryptos begin to gain social media awareness and, because of the fear of missing out, and the interest in partaking in the pie, transaction volumes and prices begin to soar.

In times like this, greed takes the driving seat, with common sense forced to sit at the back, and as the latecomers arrive, experienced whales begin to unload.

With this, prices begin to drop and those investors who can’t make a quick decision begin to see this as an opportunity to buy in and hold. When they do this, a selling climax comes in and prices go up again, resulting in reasonable gains.

Once that happens, prices get to their highest, and investors’ moods shift from one of neutrality to one of excitement.

The Distribution Phase

Here, the seller reigns supreme as the excitement of the markup phase has transcended to one of the mixed sentiments. Prices here begin to move within the same trading range, which can go on for months in some cases.

The market will go the other way towards the end of this period. Peak price technical patterns, such as double and triple tops or heads and shoulders, are likely to develop during the distribution period.

Fear, greed, and hope are the primary emotions driving this stage of the cycle. Early investors are unsure whether or not to sell and profit.

Sentiment begins to deteriorate, and a negative geopolitical incident or poor economic news might expedite this process.

For the first time, more investors are beginning to doubt their belief in an upward price movement. A severe sell-off is followed by a comeback as market participants agree that a correction is necessary before the bull run can restart.

Prices, however, never return to their earlier highs, and when they fall for the second time, fear sets in.

Those who entered relatively late and had substantial stakes are afraid of losing everything while also wanting to reclaim lost positions since the market appears to be resuming its upward trend.

Because of the traders’ focus during this period, the ratio of up to down days during the distribution phase may be rather equally divided, with considerable volatility.

As essential components take root, this period might last from a few weeks to many months, and in rare circumstances, years.

Generally, the greater the extreme highs, the faster prices fall. Investors who did not sell at a profit earlier now have to settle for breakeven or perhaps a minute loss.

The Markdown Phase

For those who are still holding on to their crypto investments, the markdown phase is the most agonizing.

Typically, the investors caught up in this period are new and inexperienced. They are clinging to their investment since it has fallen far below the price they paid for it.

This group of investors, who often purchase during the distribution phase or at the commencement of the markdown phase, may only abandon their positions if the market falls by 50% or more. Late-cycle traders lose hope and eventually reduce their losses when this happens.

At this stage, the early investors who earned excellent gains in the past will acquire depreciated assets. These new investors believe that a market bottom is near, and they will most likely profit from the ensuing markup.

What You Should know About the Market Cycle Trends

It is important to realize that a market cycle generally transitions from greed to fear and then back to greed again, and every crypto market starts with a new value and then goes through the various points of the cycle.

Notably, greed and excitement play key roles when there is new crypto on the block, driving its prices higher, but this soon develops into doubts as investors begin to take a look at the crypto’s worth, growth, or concrete, practical uses.

At this moment, the market becomes skeptical, prompting an increase in the number of traders selling their assets, resulting in a decline. When the price lowers to a level where prospective gains are attainable, greed takes hold, and the cycle begins all over again.

The Best Strategy for Investing in the Market Cycle

Recognizing crypto market cycles might assist you in making informed investing decisions.

The ideal approach for capitalizing on your grasp of market cycle stages is straightforward: purchase or accumulate at the bottom when the market is scared, HODL on the way up, sell during distribution when everyone is excited and greedy, and exit before the market plunges.

The key here is to learn not to allow your emotions to drive you towards making a crypto blunder and not be moved by the fear of missing out, which might lead to you incurring losses.

Frequently Asked Questions (FAQs)

How long is a crypto market cycle?

A crypto market cycle can last anywhere from a few days to a few weeks, as there is no specific amount of time for a crypto market cycle duration.

What is the market cycle in crypto?

A market cycle in crypto is simply a term used to describe the period between a market’s highs and lows, as well as its phases. They are a useful tool and are frequently used in crypto to predict future price movement.

Final Thoughts

Crypto market cycles are important market phenomena that should be studied by investors, especially those just entering the crypto market.

This helps you predict, to some extent, price movements and know when to take appropriate action at every given opportunity.

Read More