How Cardano (ADA) was Created

After the Ethereum team Vitalik Buterin and Charles Hoskinson parted ways in 2014, Hoskinson put together a team of his own whose contributions and expertise birthed Cardano in 2015.

Since Cardano was launched in 2017, it has been through series of developmental phases which saw the coin up the charts as one of the top 10 Cryptocurrencies today.

Cardano is regarded as the third-generation cryptocurrency and was created to solve the scalability and sustainability problems faced by Bitcoin and Ethereum. Unlike the latter two, it is faster, safer, and eco-friendlier.

Investing in Cardano

With all adequate publicity and rising market value, Cardano is yet to capture the attention of many crypto investors as expected.

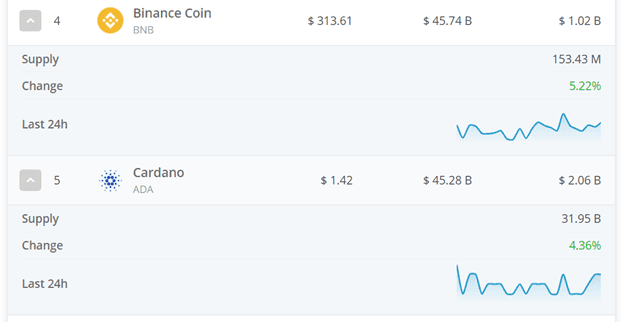

Cardano’s market cap and supply volume are also competing strongly with Binance coin.

At a little above one USD, It is ideally the best time to stockpile this coin with potential upsides and prepare to sell if Cardano gets to $10.

Asides from these numbers and predictions which surround this coin, let’s explore other reasons Cardano should be a coin to consider investing in.

Why Invest in Cardano?

1. Cardano has a fixed number of supplies possible.

Cryptocurrencies are designed to either be limited or unlimited in supply.

Once it reaches the maximum point, its creation would stop and it cannot be increased.

Cardano is designed to have a fixed quantity. It has a maximum supply limit of 42 billion and there are about 32 billion in circulation currently.

Due to its limited quantity, if the Blockchain becomes more appreciated, then there is a possibility that an increase in its demand will automatically increase its price.

2. Cardano has a wide range of uses.

It is a very versatile technology scheme whose usefulness cuts across all ramifications of life. Many industries and sectors stand to gain a lot from using Cardano.

For instance, the Ethiopian Ministry is in partnership with the crypto firm. The deal involves the blockchain company storing records of 5 million Ethiopian students.

The records would be readily accessible to the pupils when they graduate and start making headway in life.

Health: with this technology, you can easily verify the authenticity of products from pharmacies without fear of getting fake ones.

Finance: it can also be used to identify people and their financial status in developing countries.

Agriculture: supply chain which is important to farmers, merchants, and haulers can be easily tracked using the Cardano Blockchain.

3. Cardano has a high level of energy efficiency.

One of the components of Cardano which propelled it to its position as one of the top cryptocurrencies is its low level of energy consumption.

In comparison with the top two digital currencies, it consumes a very minute fraction of their energy requirement per year.

Statistics show that Bitcoin and Ethereum require 130 terawatts/hour and 50terawatt/hour respectively.

While on the other hand, Cardano requires 6 gigawatts/hour for its operation. Mathematically, 1000 gigawatts equal 1 terawatt, hence Bitcoins consume about 41,000 times what Cardano does!

The huge differences in energy consumption is due to difference in the consensus mechanism used.

Cardano uses a proof of stake consensus mechanism while Bitcoin and Ethereum use a proof of work consensus mechanism.

Proof of work model requires a lot of computations to validate each transaction.

To power the computation machines, massive electricity is consumed, hence resulting in the high energy consumption of Bitcoin and Ethereum.

Proof of stake mechanism on the other hand, only allows a few devices to validate each transaction. These devices consume less energy, hence making Cardano an energy-efficient crypto asset.

SEE ALSO: ADA Staking: the Ultimate Guide to Cardano Staking

4. It uses an open-source development approach.

The Cardano community is one of the safest crypto communities because of its open-source developmental pattern.

Its establishment was aided by contributions from crypto technology experts in engineering and other academic fields.

In its development, peer-review ensures no drastic changes are made instead, all stages are thoroughly reviewed. Consequently, all potential security problems are tackled properly, hence making Cardano safe and secure.

5. Cardano is a potential Ethereum killer.

Cardano was created by Charles Hoskinson and his team to solve the scalability problem faced by other top crypto assets. Buterin and Hoskinson co-founded Ethereum.

However, a disagreement between them in 2014 led to their separation which birthed Cardano in 2015.

It was created with striking similarities with Ethereum as they both utilize smart contracts and both blockchains are programmable, hence can be used to develop applications.

Top cryptocurrencies have a common problem plaguing them, which is scalability.

Bitcoin and Ethereum complete 5 and 15 transactions per second, respectively. Consequently, they run transactions slowly and charge exorbitant fees.

However, Cardano is highly scalable compared with the former two as it can process a large number of transactions simultaneously. Record says it is capable of processing about 257 transactions per second.

Currently, the crypto firm is working on a new technology termed “Hydra” which would supposedly enable it to process about a million transactions per second.

6. Reliable and secure crypto exchange and wallets are of great necessity.

The Cardano (ADA) crooner is one of the top blockchain firms in the crypto world.

Hence, it is quite popular with most world-leading crypto exchange firms like Coinbase, Changelly, Binance, Kucoin, Wazirx, Upbit, eToro, Bityard, Kraken, Sofi, and the likes.

However, some exchanges and payment platforms do support Cardano yet, such as Gemini exchange, PayPal, and Venmo.

Also, you need a secure wallet to keep your Cardano asset. You can either use an offline/online, a software/hardware wallet.

Hardened digital wallets Bitbox02, Trezor, and Ledger Nano X/S. Other soft wallets include Daedalus, Yoroi, coin smart. Wallets help you to hold and trade your ADA coins.

What is the Price of Cardano Today?

Cardano’s price is trading in its normal range today, but it could witness dips or surge in the cause of trading.

[mcrypto id=”4219″]

Cardano’s Historical Price

[mcrypto id=”4217″]

Final Thoughts

Investing in crypto is risky. As you aim at making profits by investing in Cardano, be prepared for the risk thereof too.

There are no guarantees if the Cardano coin would thrive or not in the nearest future.

However, it is still a fact that Cardano in all its entirety is a very promising cryptocurrency worth investing in.

No wonder why it continues to get widely appreciated globally. it is now a matter of your choice whether to invest in it or not.

Read More